“To deliver real returns, preserve and grow your core wealth.

So that you could focus on your other responsibilities.”

We discuss with you your risk tolerance and determine your strategic intention to help you achieve your financial goals by designing a bespoke and unbiased wealth management strategy. Utilizing our in-house expertise, we also utilise our panel of 3rd party subject experts in order to steer towards the goal.

Your goal is achieved through the combination of discretionary and advisory model to ensure that our implementation achieve the right balance of coverage to be forward looking, but at the same time defensive.

Independent & Bespoke

External Asset Managers (EAMs) are senior finance professionals who operate independently. Concentrating on high-net-worth individuals, EAMs play an important role in the strategic function of wealth management. EAMs are relationship-focused, advisory-driven and solutions-based practitioners.

In an EAM model, the private bank continues to act as custodian of the client’s assets and provides the trading platform. Investment advice is provided by the EAMs.

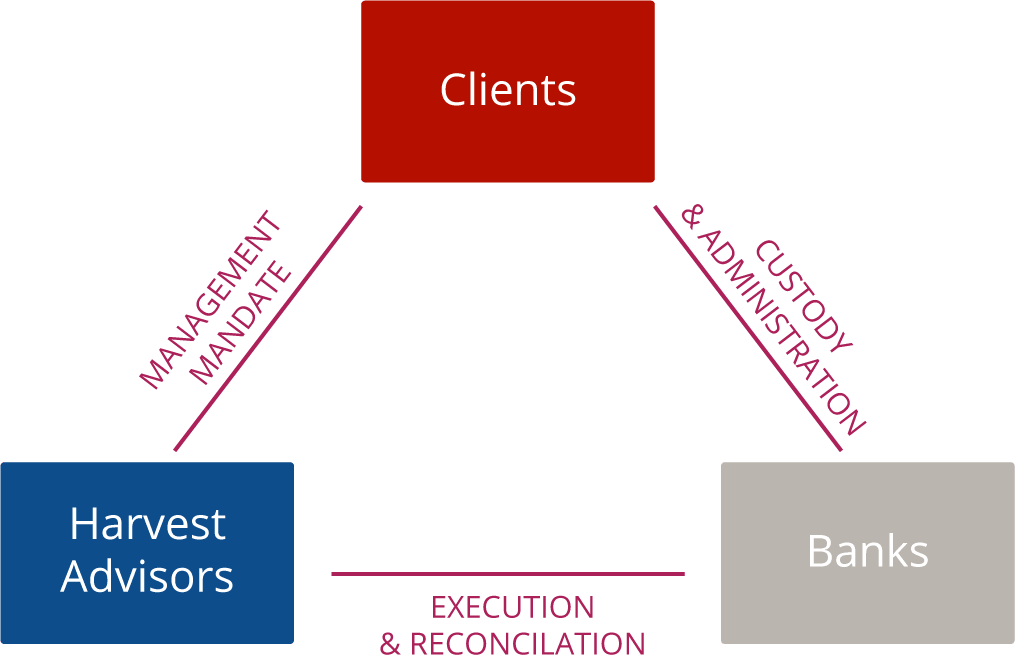

The Triangle Relationship

Our clients choose the custodian bank where they would like to maintain their account and assets.

The client issues a limited Power of Attorney (LPOA) to the manager who works for the client, not the bank.

A LPOA allows Harvest Advisors to manage the assets, but without the right to transfer of assets out of the account.

MANAGEMENT MANDATE

Harvest Advisors provides discretionary asset management and investment advisory services.

TRADING

Through a Limited Power of Attorney, Harvest Advisors gives trade instructions to the Bank on behalf of the clients’, for their accounts.

ACCOUNT ADMINISTRATION

Client keeps full ownership and control of assets as the bank acts as custodian.